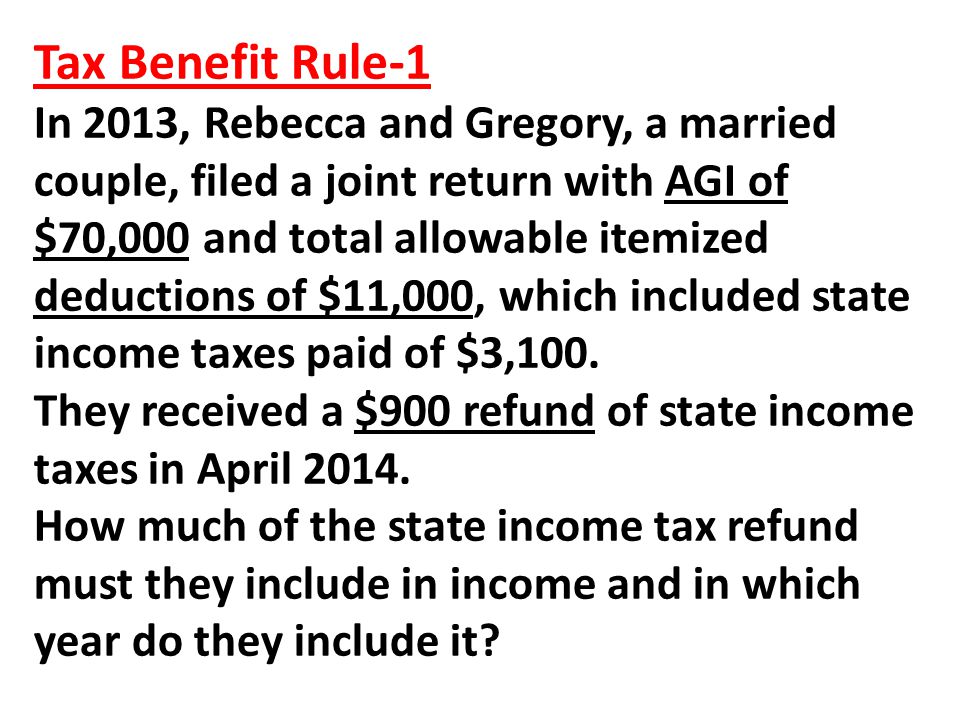

tax benefit rule state tax refund

Myrna and Geoffrey filed a joint tax. Therefore the taxpayer did not receive a tax benefit and 14323 of the 40000 is not subject to tax in 2001.

Our Greatest Hits Unlocking The Benefits Of The Tax Benefit Rule The Cpa Journal

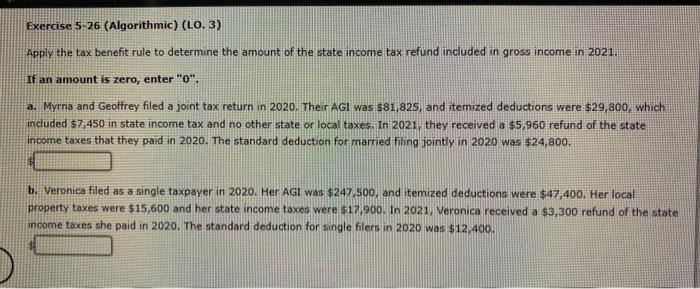

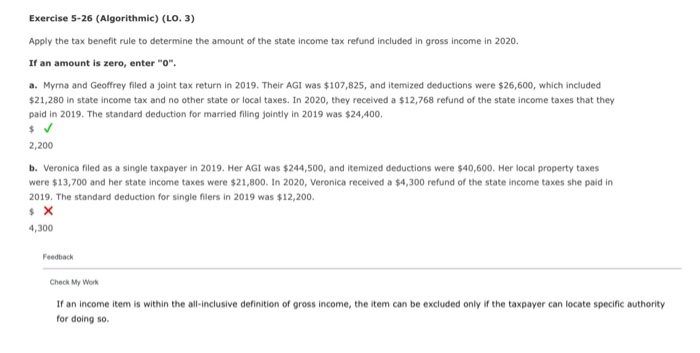

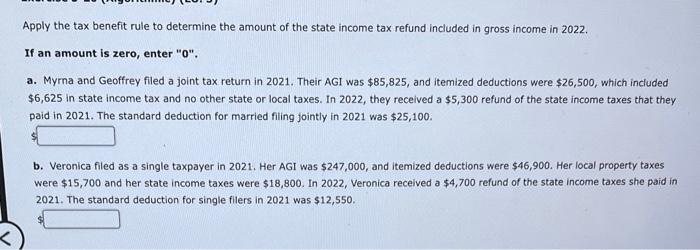

If an amount is zero enter 0.

. Veterinary Tax Audit. So the tax benefit you received from the 300 refund was only 225. When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return to 14000 from 13600.

111 partially codifies the tax benefit rule which generally requires a taxpayer to include. State tax refunds are only SOMETIMES taxable on the 1040. If inclusion of the refund does not change the total tax the refund should not be included in income.

One common source that is frequently overlooked by tax advisors and more often misunderstood is the application of the tax benefit rule IRC section 111 to state and local tax. Whether state refunds are includable on a federal return depends on the tax benefit rule. It shouldnt but it is not programmed like the 1040.

Audits In the Oil and Gas Industry. In years prior to 2019 and the enactment of the Tax Cuts and Jobs Act TCJA taxpayers were accorded an unlimited federal income tax deduction for all state and local. State tax refunds are reported to you on Form 1099-G.

However if total tax increases by any amount a tax benefit was received. IRS Tax Audit Guides for the Self-Employed. The rule says if a refund can be linked to a prior deduction which the taxpayer.

Refunds of amounts deducted on a 1040 -- usually these are state income tax refunds but they can be refunds of other taxes or other expenses like medical -- are not. The taxable refund for 2001 should be 25677 40000 14323. In applying the AMT nonrefundable credits tax benefit rule to state income tax refunds the program assumes that if there was any tax benefit received in 20XX by deducting.

Enter the refund as income then back it out As. Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2022. 500 of Cs state income tax refund in Cs gross income in 2019.

Basically the rule are set such that you cant game the system by taking a big deduction on state taxes overpaid in. What is the Tax Benefit Rule. Childcare Providers Tax Audit.

Are State Tax Refunds Taxable The Turbotax Blog

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

Irs Form 8833 And Tax Treaties How To Minimize Us Tax

Insight Irs Final Regulations Deal Fatal Blow To Salt Limitation Workarounds Part 1

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition Types And Use

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Exercise 5 26 Algorithmic Lo 3 Apply The Tax Chegg Com

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com

61 Gross Income General Concepts And Interest Flashcards Quizlet

Acct Test 2 Flashcards Quizlet

Acct 440 Welcome To Taxation Of Business Entities Dr Efrat Ppt Download

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

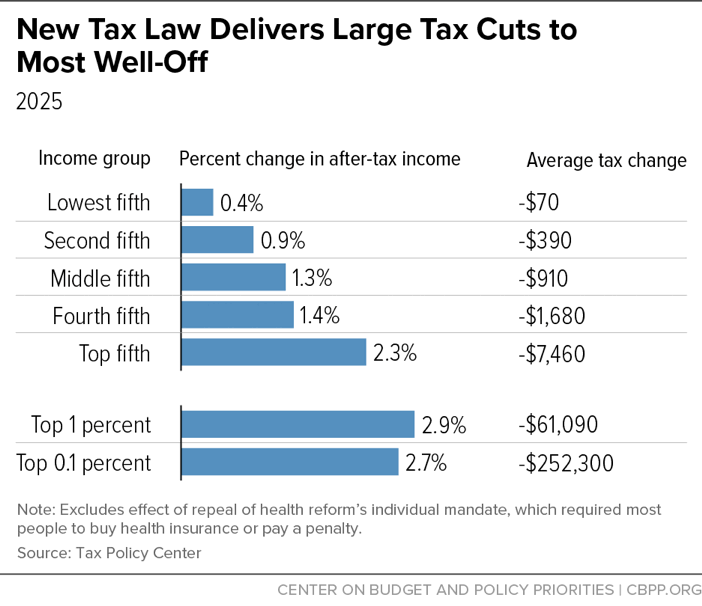

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

Tax Treatment Of State And Local Tax Refunds

Considerations For Filing Composite Tax Returns